The Tax Cuts and Jobs Act passed December 22, 2017, and while parts of it went into effect immediately, 2018 was the first full calendar year under the new tax code. So this spring, American taxpayers will get their first look at how the new legislation impacted their refunds.

Here are a few changes that will impact many Granite Staters.

For your trickier questions, skip to the end of this page for resources and where to find a CPA. For our Exchange conversation on the new tax code, listen here.

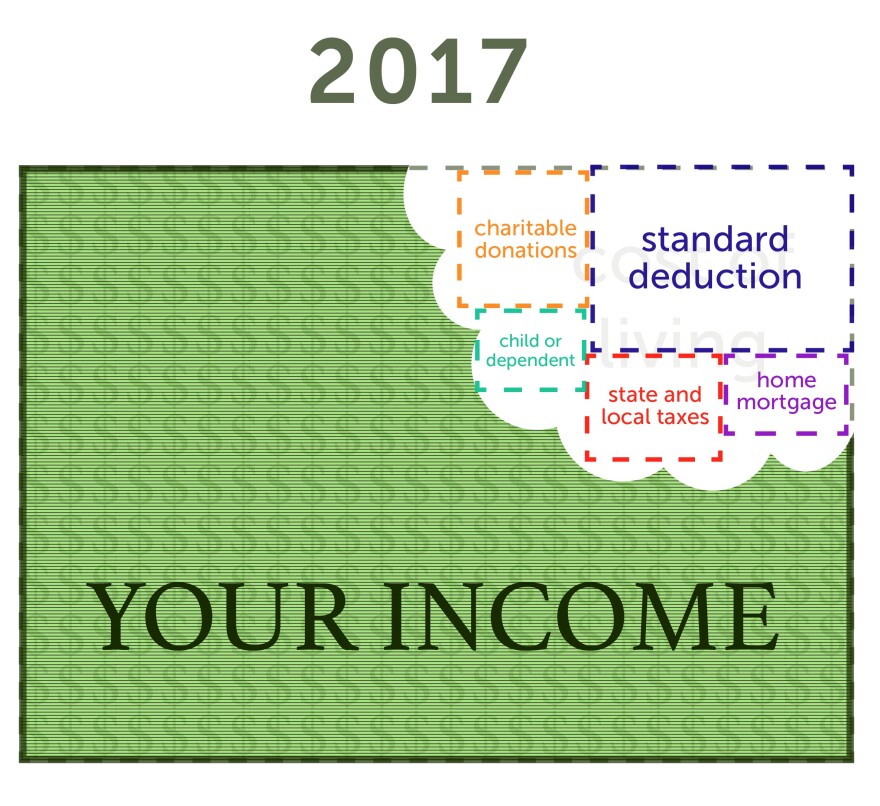

1. The Standard Deduction has increased:

A quick definition of the standard deduction: The standard deduction is a simple flat rate deduction—that’s available to all taxpayers. Itemized deductions allow taxpayers to claim a bigger total deduction. "It's an amount that you're allowed to take off the top," says Cary Gladstone of Granite United Way. "The IRS says “we’ll give you this much tax free.”

“Standard” sounds like one amount but there are three different filing statuses affected by the standard deduction:

- Single - $12,000

- Married, filing jointly - $24,000

- Head of household -$18,000

“And that's not counting people who are 65 or older, or blind; there's an additional amount added to the standard deduction,” according to Gladstone. “But it's good to know that, depending on your filing status, anyone who qualifies to file a tax return is allowed to take a certain amount off the top. If your income is below that standard amount, you're not required to file a tax return.”

And of course there are always exceptions. “Self-employed people have to file a tax return if they made over $400.” Gladstone says.

Because the standard deduction is larger...

"Essentially this means that instead of trying to look at all the different issues [you can itemize]: maybe it's mortgage interest," says Jill Schlesinger, CBS News business analyst. "In New Hampshire, there’s no state income tax so you wouldn't be deducting that, but there are local taxes...or charitable deductions. If you're claiming the standard, you take this amount and you keep moving through the process.”

2. The Child Deduction was reduced to zero.

More standard deduction, fewer itemized deductions: Under the old tax law, taxpayers could itemize their deductions, meaning use the cost of certain expenses to reduce their total taxable income.

The tax overhaul raised the standard deduction and removed a whole list of smaller deductions, including the dependent or child deduction.

You can still use your children for tax purposes: The child tax credit went up. Credits are different than deductions. Gladstone describes a tax credit as "a gift card to pay your taxes directly.” There are two kinds of credits: refundable and nonrefundable. So if the tax credit is greater than the tax you owe, you get the rest back as a cash refund.

But the child & dependent-care tax credit is a nonrefundable credit, so you can only use that credit up to the amount you owe on your tax bill and the rest goes away. As IRS.gov puts it: “A refundable tax credit may give you a refund even if you don’t owe any tax.”

Maximize your credits: Anyone who has a child under age 17 is eligible for the child tax credit. That credit was $1000 before 2018, but increased to $2000 under the new tax code. However, not all of it is refundable.

Don't leave money on the table: The $500 credit is “still in place...for anyone who has a child up to age 24, if they're a full-time college student, or [a child of] any age, if permanently and totally disabled,” according to Gladstone. "Parents of college students can take that dependent credit," Schlesinger added, "as well as education credits."

“[In] every [tax] situation, you're going to find winners and losers." Schlesinger added about the child credit change. "That is essentially what the tax code has always been.”

3. Your Tax Cut is not the same as your refund.

It’s not about the size of your refund, according to Schlesinger: “So many people...did not realize that part of the [new] tax code meant that they were taking home more money throughout 2018 and as a result...they maybe did not get as big a refund as last year. But that didn't matter. They still got a tax cut.”

Schlesinger sees it as two issues:

- Tax cut vs. withholding.

- Refunds vs. owing the IRS money.

You receive a refund when you withhold too much money. “So it's not about the tax cut itself, it's how much you are actually sending to Uncle Sam out of your pay," says Schlesinger. “And that's different than: What is your overall tax position this year vis-a-vis last year.”

Pull out those paystubs: “Employers were instructed to change the withholding tables," according to Gladstone. "Withholding is the amount of money people have taken out of their paycheck. So let's say you had ten dollars more per paycheck each week. Over the course of a year, that's $500 more, [and you notice that] especially when your tax refund is $500 smaller [this] year.

Still more questions? Ask a professional.

Taxes are complicated and this doesn’t cover it all. For further questions, we suggest you get professional tax help. There are many resources available for Granite Staters. We’ve collected a few here for you. And remember taxes are due April 15th!

- If you can't afford a CPA:

Granite United Way hosts the Volunteer Income Tax Assistance (VITA) for N.H., free help filing taxes for people who make under $55,000, also people with disabilities or limited English.

- See if they can help you.

- Find a local VITA center.

- Set up an appointment, call 211 or visit NHTaxHelp.org

- Collect important documents.

- If you don't know what to expect:

Start with a quick calculation on the IRS Withholding Calculator. Plug in your income, see what deductions you qualify for, and get an idea of what your refund will look like before you file. This can help you budget if you end up owing Uncle Sam money. And if your refund looks good, you should probably wait until that refund check is in your hand before you start planning a vacation or paying off debts..

- If you know you need a CPA:

Search here at the New Hampshire Society of CPAs and call soon! Tax season is the busiest time of year for CPAs.

- If you're looking for a cheaper way to file:

If it looks like you’ll end up owing money, consider ways to file your taxes for free. H&R Block and United Way provide an online option for NH residents at MyFreeTaxes.com for taxpayers who make under $66,000. And the IRS offers free filing options for taxpayers of any income level.

- If any kind of payment is out of the question for you:

See if you qualify for the Earned Income Tax Credit. The bar for this credit is very low. You can check eligibility here, but the EITC is a refundable credit, so if you qualify, you could be getting a check from Uncle Sam.

Check out the other resources at IRS.gov. like the interactive tax assistant or the IRS2Go app to check the status of your refund.