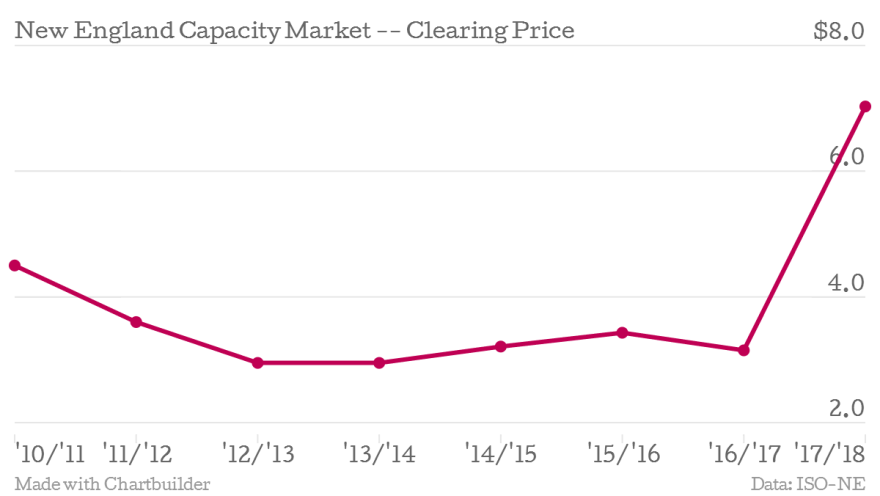

Power plants get paid just for being ready to turn on if they are needed, in something called the capacity market. And a recent auction in that market has revealed that in three years the region will experience a power shortage. This in turn means that come 2017, existing power plants in New England will be paid nearly twice as much just to keep their doors open.

For seven years, plants have been getting the minimum payment, because too many were bidding into the market. But this year, the 600 megawatt Vermont Yankee nuclear plant, and a 1,500 megawatt coal plant in Massachusetts called Brayton Point are retiring, and the region suddenly is finding itself short on power plants. Thanks to a 155 megawatt shortfall the region will be paying a lot more to keep the ones that are left online.

A Quick Explanation of the Capacity Market

This capacity market hasn’t been around for very long. It started when the New England states “deregulated” their electricity markets, forcing state regulated power monopolies to sell their power plants and let competitors sell electricity over their lines. But in a market where the commodity in question can take years to bring to market, but is absolutely essential for day-to-day living, regulators had to figure out how to make sure there would always be enough power plants around to fuel the region’s demand for juice.

Enter the capacity market. Power plant owners and developers bid into this market three years in advance, saying they will supply power for the year in question. The bidding is a descending auction, meaning it starts at a price that everyone agrees on and as it decreases, power plant operators pull out when the price gets too low for them to stay in business. Once the number of bidders reaches the level that the grid operator, ISO New England, has determined is necessary to keep the lights on, the price is set, and everyone gets paid that price. The money to pay them comes from utilities, who a pay a certain amount into a big pot of money depending on how much electricity they sell per year. That price then gets passed along to you and me.

This last auction was the eighth, and it was the first time that there weren’t enough plants bidding to reach the bar that the ISO had set for “system reliability”. This meant that prices jumped, big time. Last year, the auction cleared at $3.15 per kilowatt per month, which was the floor price; this year the price was set at $15.

That price was so high that market rules designed to protect consumers kicked in. While anyone building a new power plant will get the $15 price (so that the market still sends a price signal to build new facilities), all existing plants got an already agreed upon ceiling price, $7.025. Only half what the market was demanding, but still more than double what they were getting in the last auction.

What Does It All Mean?

For anyone who buys electricity from a deregulated utility, it means that rates are going to go up. In New Hampshire, that’s Unitil, the NH Electric Coop, and National Grid. We don’t know yet what exactly that will translate to on the bill, but ISO-New England estimates the capacity market will cost more than $3 billion dollars in 2017, almost three times more than the previous year, when it was $1.06 billion.

But for Public Service of New Hampshire consumers, there is a silver lining. The legislature shied away from making the Granite State totally deregulated and let PSNH hold onto their power plants, which means the utility will make more money from this auction. Again, they will have to pay more into the $3 billion dollar pot, but in an e-mail spokesman Mike Skelton said that broadly speaking the higher capacity payment will “create downward pressure on our rate.”

PSNH also jumped on the occasion of the 155 megawatt shortfall to again sound an alarm that it has used to promote its controversial power line, the Northern Pass.

“If we just look at what’s on the horizon and what’s being planned, are there the projects and assets in progress that will actually fill the space that the plants that are leaving the market are creating?” asked Skelton.

Of course not everyone is so concerned.

“The shortfall is 155 megawatts, that’s in a 33,000 megawatt system, we’re not talking about a big number here,” says Dan Dolan President of the New England Power Generators Association, which represents power plant owners that generally compete with PSNH.

Dolan says a smaller mid-year auction will be conducted to “fill in the gaps,” and he believes the shortfall will vanish in that auction.

“What is, I think, more notable is what does this mean for next year’s auction?” says Dolan, “I think it’s sending a very clear price signal to other investors, to other developers to take a much more serious look at New England as a region worthy of investment.”